Photo courtesy DepositPhotos

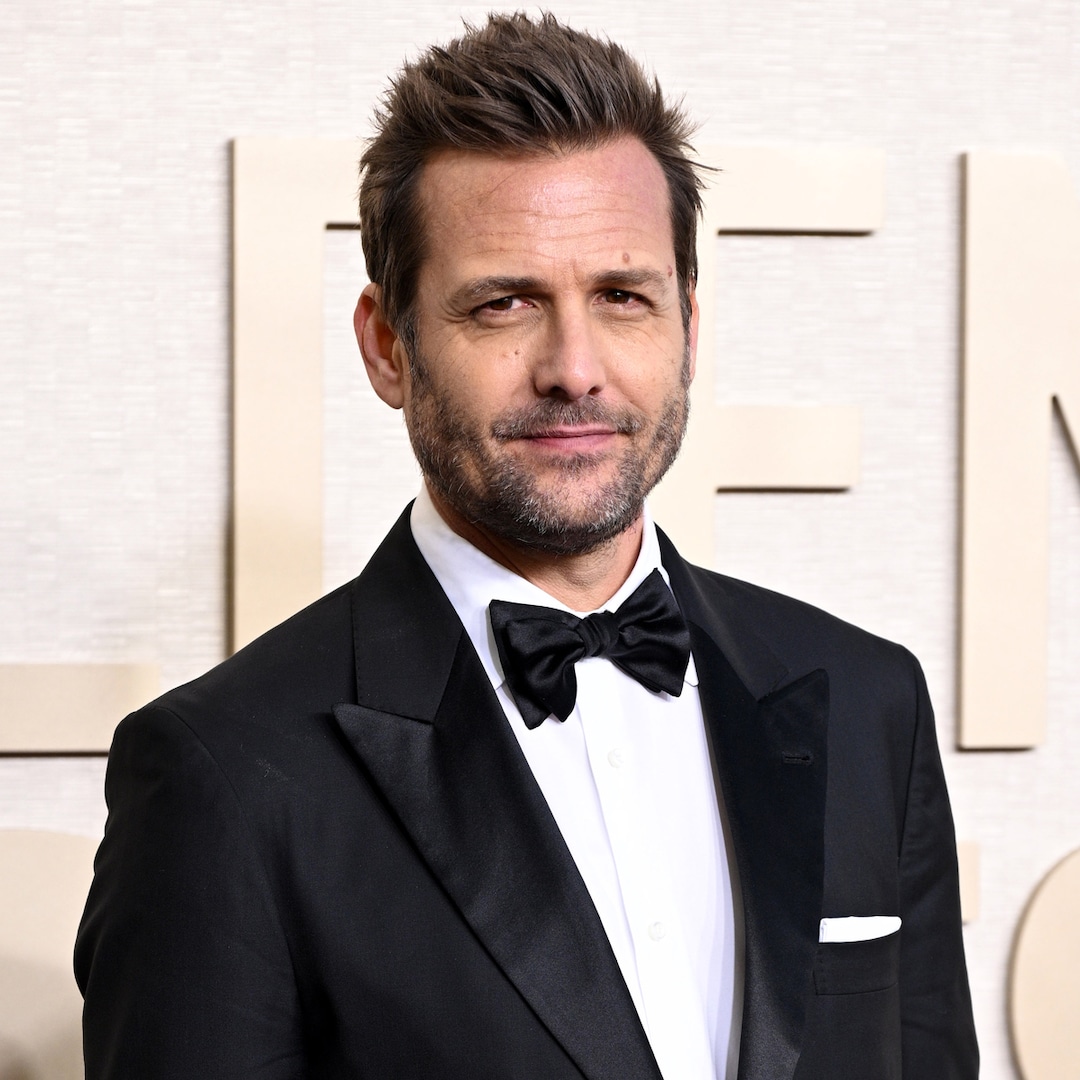

Colette Wharton

Colette WhartonColette Wharton, regional asset manager of The Feil Organization, a national real estate investment firm based in New York, discusses with CityBusiness the current state of the office market. Wharton manages Feil’s 30 Louisiana properties totaling 11 million square feet of office, retail and multifamily space in Metairie and New Orleans. These assets include Lakeside Shopping Center, Causeway Plaza, The Galleria, Lakeway 1, 2 and 3 and the land on which New Orleans’ only Costco sits.

Wharton has more than 18 years of experience in real estate investment, development and operational experience throughout the U.S., including nearly five years in the Metairie region.

Recently, Feil announced Marsh & McClennan Agency signed a new 10-year lease for 12,146 square feet on the third floor at Causeway Plaza, located at 3300 W. Esplanade Ave. in Metairie. According to Wharton, a Fortune 500 company and one of the top insurance brokerages in the world, Marsh & McClennan Agency’s lease at Causeway Plaza signifies strong momentum within not only Feil’s office portfolio, but Louisiana’s commercial real estate market at large.

Can you provide background on Feil’s connections in New Orleans?

Louis Feil, the late Founder and father of Feil Organization CEO Jeffrey Feil, played a significant role in the New Orleans area real estate market during his lifetime. In 1968, he acquired Lakeside Shopping Center by purchasing it from the original developer. This marked the beginning of his extensive investments in the region. Over the years, Louis Feil continued to acquire land and properties, establishing a strong presence in the thriving New Orleans market. Today, the Feil Organization owns and operates 7.8 million square feet of retail, office, residential, and industrial space and 550 residential units throughout New Orleans and the surrounding market.

What is the current state of the office market nationally and how does that correlate with the state of New Orleans’ office market?

Higher interest rates, costs, and persistent remote work models have certainly impacted the national office market landscape, and the New Orleans area isn’t immune to those forces. At the same time, a recent Corporate Realty 2022 Greater New Orleans office market report revealed that New Orleans’ office market is quite stable, with a gradual return to office trend in place since last year, in some format. It’s not perfect, but a sure sign that high quality office space and management is even more important to maintaining competitiveness than before. What’s driven our success at the Feil Organization is a commitment to investing in our tenants and tailoring to meet their needs, and that’s a winning formula.

What is the state of office leasing in New Orleans?

While we don’t have any office buildings in the city proper, we do have a presence in the outskirts of New Orleans comprising the greater New Orleans area. In this area of our portfolio, we’ve seen continual interest from a pool of potential tenants, as well as increased deals and occupancy throughout our Class-A assets, such as The Galleria and Class-B assets, such as Causeway Plaza, both in Metairie. Many of the deals involve small-to-mid-size leases, but it’s part of the gradual growth we see happening in the long-term.

Do you have any numbers or data to quantify?

Our firm maintains a high-quality data management system, including tracking our occupancy, leasing requests, and deals, but it’s not our standard practice to release specific information.

Do the surrounding submarkets attract top tenants?

Yes, what we’ve seen is a strong demand for additional office spaces to service customer segments in these submarkets (such as Metairie) who don’t want to/it wouldn’t be feasible to travel downtown. There’s also a cost element to it, some tenants have moved from downtown to the surrounding submarkets in search of lower gross rents and greater stability over time.

How has Feil invested in its office portfolio to adapt to the modern workforce?

The Feil Organization continues to experience leasing momentum thanks to its modernized tenant recruitment and retention strategies. Part of our strategy is simply following the enduring wisdom of the Feil Organization’s late founder, Louis Feil, who always said, “Take care of your buildings and your buildings will take care of you.” As such, we routinely invest significant capital into the office portfolio, via lobby and common area renovations, amenity repositionings (such as sundry shops, food and beverage, and conference spaces) and the construction of spec suites that are ready for immediate tenant occupancy.

What kinds of industries and companies seek out office space in the greater New Orleans area?

Our office spaces can accommodate a wide range of tenants across market sectors, but we do see that the most active is engineering, followed by law, accounting, and insurance firms. These type of firms look for top tier office space with diligent and responsive management, many of our properties have onsite staff ready to assist and ensure that our tenants occupy an environment that is conducive to the maximum benefit of their workforce, clients, and partners. Ultimately, we invest significant time, energy, and resources in our tenant spaces.

What is the biggest challenge facing the New Orleans office market?

The biggest challenge for the New Orleans market is establishing a steady stream of new businesses into the area, as opposed to simply moving tenants from one part of the area into another part of the area. New Orleans and the surrounding submarkets are a business-friendly, wonderful place to be, unfortunately, we are also competing against top geographic markets such as San Francisco, New York, Los Angeles, Miami, Houston and so on. That creates a natural uphill battle when it comes to attracting fresh tenants into the market. That said, as evidenced by the latest data, it’s encouraging that there’s a bit more stability in our area than in other parts of the country, and that’s bound to be an attractive prospect for future companies looking to plant their flags here.

Is there anything else you would like to add or a question I should have asked?

Since its inception, the Feil Organization has been deeply committed to pragmatic portfolio management, as well as diversification which has positioned us for stability and success throughout our portfolio. New Orleans in particular, is special to the Feil portfolio, because not only do we own multiple office assets throughout the Greater NOLA area, but we maintain retail assets such as the Lakeside Shopping Center in Metairie, residential such as May & Ellis in New Orleans, and industrial space. As we forge on in our growth in New Orleans, we’re proud to be able to continue serving the community and its continued development.

a

English (US)

English (US)